Changing Rules and Changing Audiences - RAJAR Q3/2024

Plus Kate Thornton (Greatest) Hits The Afternoon

The changes to the UK’s radio regulations kicked in last week. Local radio stations are now freed from their format restrictions, have been given complete flexibility on any local programming, and services in the country’s ‘nations’ no longer have any additional requirements. The only committments that remain are those around providing local news.

A sensible decision as local monopolies have disappeared and digital competition for listeners and advertising has supersized, or a terrible indictment on the country’s commitment to local content? Perhaps somewhere in between.

The final nature of the country’s commercial radio networks is now up to the people that run them - Global, Bauer, Communicorp, Nation and News UK - as well as the handful of remaining local radio operators.

Changes can be made in network programming, but also down to the transmitter level - which will broadcast what?

Money drives much of the decision making, from staffing costs to running buildings but they’re also thinking about how audiences are changing, what advertisers demand (or understand) and how stations sit alongside their competitors.

First out of the gate with a change is Bauer Media who are removing the regional afternoon shows from Greatest Hits Radio, meaning that Kate Thornton will be replacing Heidi Secker, John Marshall, Mark Collins, Andy Goulding, Martin Starke, Scott Temple & Holly Day, Steve Priestly, Tony Wright and Stuart Webster.

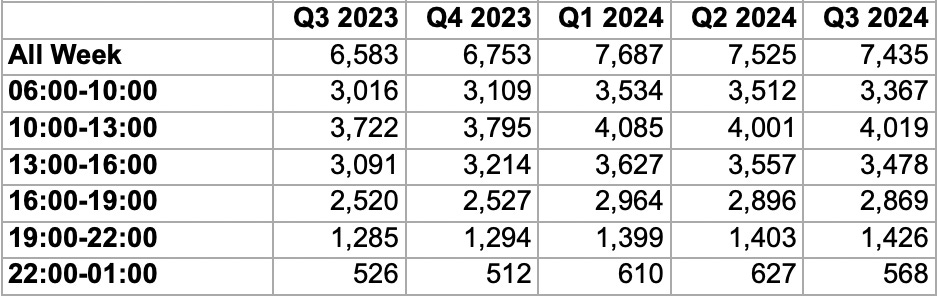

This afternoon show is second only to Ken Bruce in the ratings in both reach and share. Reach is below, but its share of 7.3% is higher than the station’s average - 6.1% and only Ken Bruce at 8.7% beats it.

Of course, it’s not just the presenters that make it a success - the music, Ken’s lead-in, brand environment etc are important too, but it’s hard not to feel sad for a group of people that clearly have been doing something right.

Looking at its overall figures, the network was down a fraction quarter on quarter, but up significantly year on year, as it added more stations to its network. As the changes have settled, it will be interesting to see how it does going forward. The press release says it’s “the most listened to commercial station in the country and has 7.4m weekly listeners” - this is based on its hours of 64m. More people tune in to Capital and Heart, however, with 7.5m and 9.7m reach respectively.

It’s hard to look at the Kiss and Hits numbers in London, as Bauer has replaced the Kiss London RAJAR Entry with a Hits London one that combines Kiss’ analogue audience with Hits’ digital one, even though it was barely on-air on the quarter. I had a go at piecing it together but it was tough. It’s likely Kiss in London would have seen a decline, probably to the point where Capital Xtra London is likely neck and neck, or even a little ahead. I similarly found it difficult to decode the broader Hits Radio network which combines recently rebranded stations, differently branded Scottish stations and a pure play version of the network too. Bauer suggests its reach is 7.2m.

Kisstory remains the stand-out part of the Kiss brand, delivering 2.3m reach (stable q-on-q, down from 2.5m y-on-y) and 9.1m hours vs the regular Kiss at 1.6m reach (down from 2m q-on-q and 2.5m y-on-y) - who suffered from losing attribution of analogue listening in London and the regions too. Nationally the mostly digital Capital Xtra leads it, marginally, at 1.7m its best figures since 2019.

Poor figures for Magic with reach down to 2.2m nationally (from 3.1m a year ago, and 2.6m last quarter) and in London a year on year drop from 1.5m to 1m. It’s going through a recently instigated programming change with a music shift at the moment no doubt to try and adjust this direction.

Absolute celebrates its highest ever network figure at 5.7m, though the main station falls a little back this quarter and is around 400k down year on year.

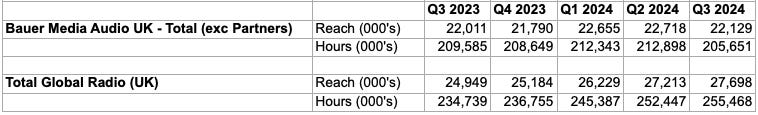

Looking at the two main radio groups, Bauer’s reach is pretty flat over the quarter and the year, but its hours have dropped. Global, on the other hand, has seen sustained growth and a significant hours jump.

Both groups have altered their national digital line-ups recently, with big changes for Global as they add 12 new stations. It will be interesting to see how that plays out in future RAJARs.

Late last month Bauer issued a press release talking about the business - “In Audio, Bauer is pursuing a growth strategy based on a lean broadcasting business and investing in digital audio offerings, as well as enhancing efficiency and collaboration.”

It’s a surprisingly honest line. There are lots of excellent things about Bauer’s business and something like Greatest Hits’ speedy evolution clearly shows a great ability to innovate. I think the challenge for much of the non-spin offs - the core stations like Absolute Radio, Magic and Kiss - is they lack any real investment. I haven’t seen any marketing for them, and there’s clearly a talent bill reduction - shown by Frank Skinner and Ronan Keating’s departure. It would definitely fit the ‘lean broadcasting’ description above.

A lack of marketing, reduced talent, combined with a significant proportion of airtime being given over to networked contesting makes growth for these services significantly harder to deliver.

For my radio fan side, this of course makes me sad. On the business side of my brain I understand it. Radio is massively more efficient than it used to be and changes that “enhance efficiency” make them much more profitable businesses. Premium rate revenues are a big part of that. But there can be a dangerous situation where stations rely more and more on them. If you make the radio stations less listenable, any short term gains will soon be outweighed by a declining audience (and then revenue).

At the moment in the “Rayo Network competition” across all the stations, they’re giving away an impressive £400,000. However after a few years of non-stop cash giveaways, it can seem pretty unremarkable on-air, especially as the mechanic has been streamlined to “register and wait for a call” no doubt to remove friction to generate more £2.50 texts. There’s not a lot of passive entertainment value there for listeners whether they choose to play or not.

Global

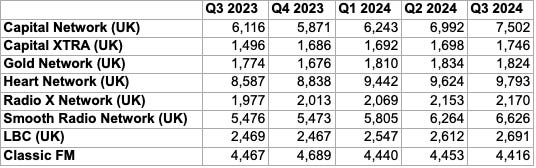

Over at Global, as mentioned above, some sustained growth across the group with decent year on year progress for all of its main networks, except for Classic FM (with perhaps its worst reach number for a few decades). Capital and Heart are particularly impressive.

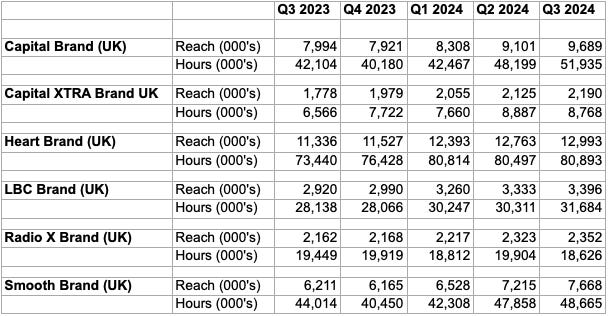

Widening the look to the brands, to take into account the spin-offs, you can see the significant impact they made, particularly on the hours side:

BBC

The BBC has done pretty well this quarter. Radio 1 and 2 seem to have stabilised. Radio 3, 4, 5 and Sports Extra did well. Radio 3, had its highest ever hours.

The story for local radio in England remains poor. I’m sure it’s still recovering from changing so many shows, but I don’t hear about much marketing, or adesire to try and benefit from commercial radio’s evacuation from local programming.

AOB

If you haven’t caught it, do check out my podcast - The Media Club. Watch it on YouTube and Spotify, listen to it on Apple, Amazon Music and everywhere else you get podcasts. This Friday me and Adam Bowie will be catching up about RAJAR. You can read his blog analysis about this quarter here. There’s also more data at Radio Today.

Thanks to Hallett Arendt who’s excellent Octagon software allows me to analyse RAJAR data so quickly.

What have I missed? Leave it in the comments.

That’s a fair point about the decline of BBC Local Radio but no one is making any decisions about changing a programme regime that has lost another 15% of listening hours year on year. (RAJAR).

And marketing? There isn’t any, simply because there is no longer a USP for BBC LR in England as most shows are now either regional or national.

In other words most programmes are NOT RELEVANT to a local audience.

You are dead right in pointing out

the BBC is missing a massive opportunity.

I’m finding the competitions on Bauer (and Global for that matter) extremely tiresome. As a regular listener, they feel like they’ve taken over the vast majority of airtime aside from the music and because it’s a rolling thing (seemingly with no beginning or end) it is tedious and repetitive. Surely this isn’t something they’re looking to drive listeners away with? Because they are.