RAJAR Q4/2025

The latest from the UK radio industry

Every quarter, the UK radio ratings come out from trade body RAJAR and we’ve just had the data for the final quarter of 2025. There’s quite a lot of red ink with many stations and groups seeing declines.

this edition of the newsletter is supported by radio experts - a sound perspective - who help agencies and their clients plan, buy and create successful radio and audio campaigns that put them ahead of the pack. find out more at radioexperts.co.uk

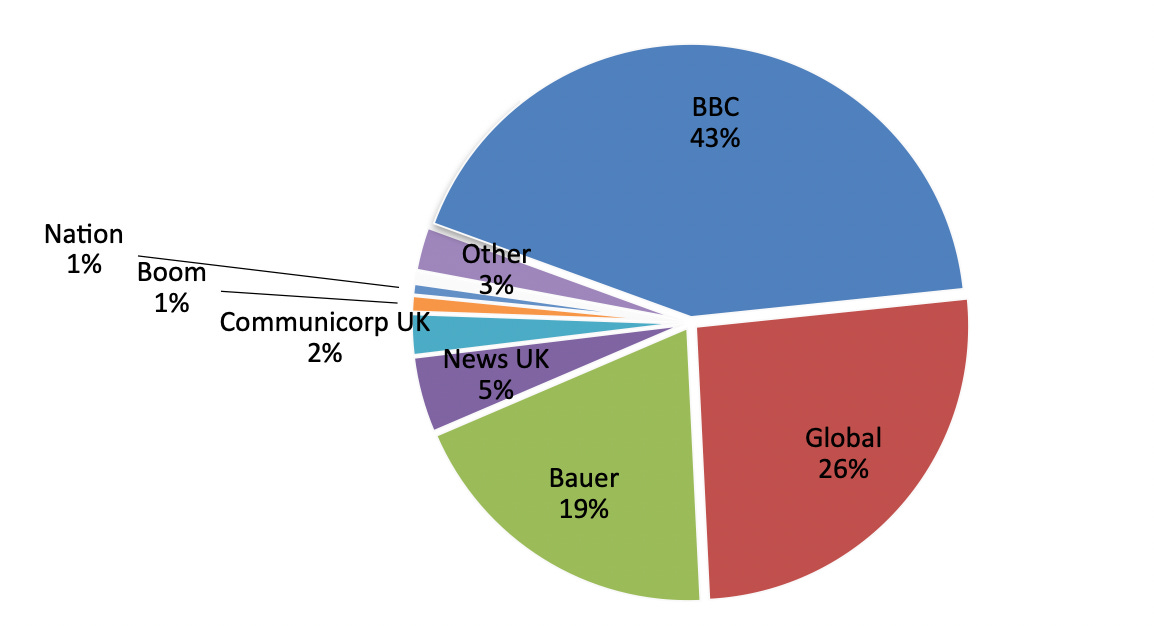

The UK market is pretty consolidated. Looking at total hours of listening - where we have around a billion - the three main players have the vast majority, with the rest fighting over the final 12%.

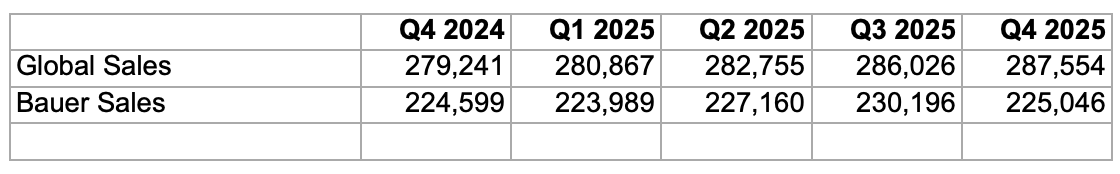

The dominance of the main players makes some of the concerns over ratings look fairly minor. When we compare the sales operations of Global and Bauer, looking at the hours from this quarter and the previous year, we can see that whilst there’s some variance it’s not going to change the fundamentals of their businesses. Indeed the breadth of stations means that if someone leaves one station, there’s a pretty good chance they’ll end up at another station from the same group.

I’m always intrigued when comparing the nature of our industry with that of a comparator like Australia. If you want a deep dive, the excellent Game Changers Radio and the new Quarter Hour podcasts will keep you up-to-date on those markets.

On Game Changers there’s been an interesting discussion about whether UK ex-pat Christian O’Connell’s new breakfast show is truly national as he’s on FM in Sydney and Melbourne, whilst ‘only’ on DAB+ in Adelaide, Brisbane and Perth. This is a conversation we would never have here, for the radio groups, it’s the network sell that’s the focus. Broadcasting Capital in London has advantages, but every listener across the UK is treated the same from a national revenue perspective. Indeed it’s hard to buy Capital’s historic analogue locations on their own, with impacts wrapped into the Capital brand spanning Anthems, Chill and Dance too.

Similarly the importance of winning ‘London’ or ‘Bristol’ has almost entirely vanished. This would be an anathema to our antipodean colleagues where City-based breakfast winners are a core part of their radio conversation.

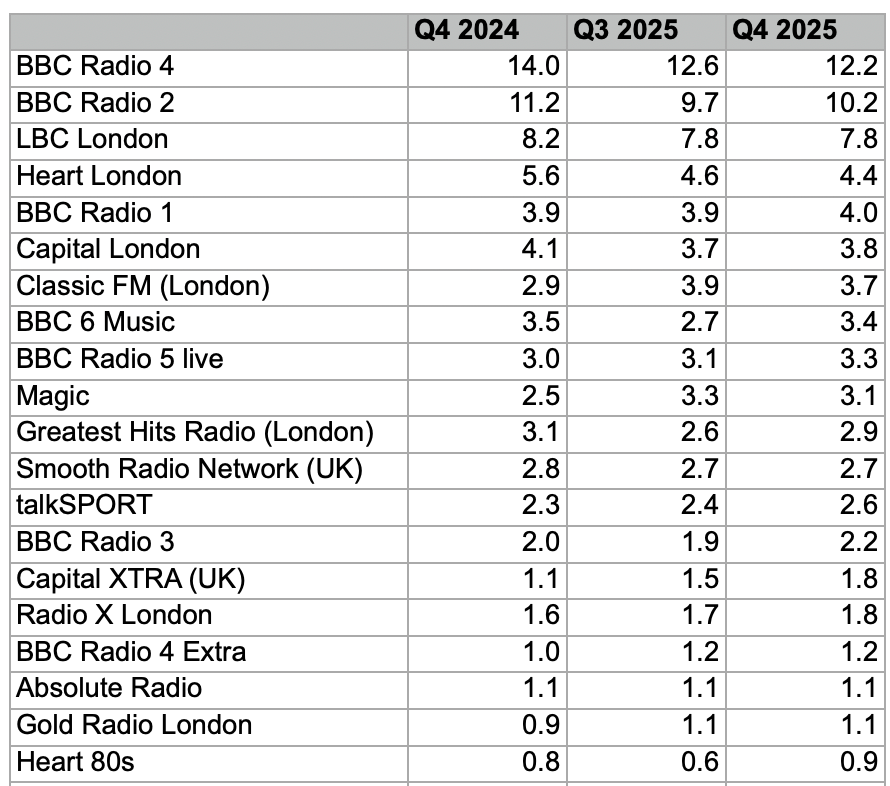

If you do take a snapshot of London looking at market share, the top 20 stations are as follows. The majority of the top stations have stayed stable, though interesting to see BBC 6Music as the 8th biggest station ahead of 5Live.

One station that would have done well in the past was Kiss - regularly top 10. Now, without it’s FM licence or much marketing, it’s 42nd in my share list - doing just 628k hours. 20 years ago (Q4/2024) it did 8.1m!

Our consolidated sector has seen the nationalisation of much of the commercial sector’s programming often with only our nations - Scotland and Wales being blessed with some local programming content (Northern Ireland has been almost totally left alone). To take our Kiss example that’s now a national digital-only station with 1.2m listeners and 5.4m hours and its network does 3.4m listeners and 16.4m hours. Maybe London just doesn’t matter any more?

The local execution of national brands like Heart, Capital, Hits and Greatest Hits is mainly limited to news, weather, travel and the local ads now. Part regulatory, part strategic its still seen as valuable ways to enhance the output. Indeed, for Bauer, their Hits and Greatest Hits networks often appear on local digital multiplexes with local news, weather and travel even without any regulatory committments.

The transition to the nationwide structure has seen the local operations for the groups significantly reduced with less people and less buildings. This has made the local sales operation less of a focus than has historically been the case.

Some people argue that this previous local revenue is still for the taking. I think there’s definitely opportunities but the difference from the 90s commercial radio heyday is stark. Back then there were so few options for that big local car dealer, that the local radio station was guaranteed significant spend. The rise in self service digital advertising from Meta and Google does mean that radio monopoly has vanished.

It’s not something I can confirm, but someone told me that Bauer now make more money from their premium-rate contest Make Me A Winner, than they do from local advertising.

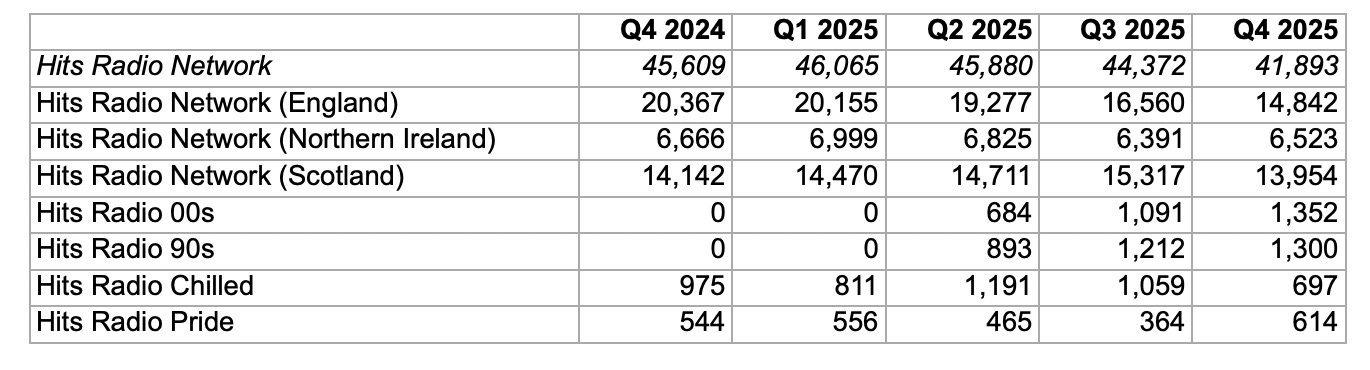

Bauer were one of the last to nationalise what is their Hits Radio England stations. It’s had a dramatic effect. Whilst there’s been a drop in reach from 3.8m to 3.1m, the real change is the hours. With a reduction of a quarter from 20m to 15m.

This is, to a certain degree, masked by the success of other parts of the network as well as the new spin off services. Whilst the drop is still visible it has less of an impact when seen (and sold) as a network.

Bauer’s networks took a bit of a hit across the board. Year on year, Hits is down 8.1% in hours and 5.4% in reach, GHR has seen a drop of 8.6% reach and 2.4% hours, Absolute’s down 4.6% hours and 3.1% reach whilst Kiss’ hours are up 4.3%, but reach is down 9.6%. Magic is seeing some green shoots with the network up 14.1% reach and 3.1% hours.

BBC

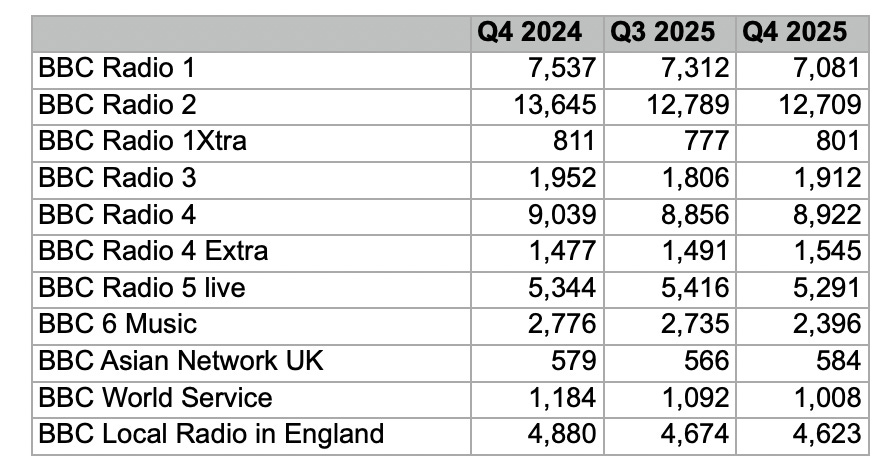

The BBC’s main pop stations haven’t had a great time of it this quarter, looking at the reach, Radio 1’s hovering at the 7m mark, Radio 2’s lost a million over the year and 6Music (nationally) has softened too.

Thanks again to radio experts - a sound perspective, for sponsoring this post and also thanks to Hallett Arendt who provide me with Octagon, the perfect way to analyse your radio data!

AOB

On The Media Club, out Friday, I’m up in Glasgow speaking to the team behind STV Radio and I’m also catching up with Adam Bowie to talk RAJAR. Follow the podcast to get it in your feed.

If you enjoy these posts, do check out The Media Club substack. It’s based on my weekly podcast and as well as a post about each episode, every Monday I write Briefed, which runs through what ALL the other media podcasts have been talking about. I think it’s really good, and you can subscribe for free!