RAJAR Q4/2023

Tracking changes across the sector

It’s RAJAR time again. Thanks to Hallett Arendt and their brilliant Octagon software I got to run all of these numbers on Wednesday so I had something hopefully interesting to show you today.

Bur before we get there though, are you someone that has something to do with music or podcasts? If you do MIDiA Research are keen to ask you a few questions. One respondent will win $1,000 and everyone gets a copy of either their State and Future of Music or Music’s Podcast Potential report. Fill in the survey here.

Wow, two live reads in a row.

I remain intrigued by groups making big changes and the impact it has (or doesn’t). Radio and its audiences have changed so much over the past few years, it’s difficult to tell what will happen when you do something big.

Global relaunched the Scottish incarnations of Heart and Capital in May last year, but the latest figures show little change so far, with both reach and hours marginally down year on year.

Over at Absolute in May 2021, it lost its FM frequencies to Greatest Hits Radio and then it’s AM frequencies were turned off in Jan 2023 making it a digital-only station. Its FM change happened during the COVID RAJAR related pause, so if we look at the pre-COVID RAJAR of Q1/2020, it had a particularly good book, delivering 743k reach and 5.5m hours and now in London, digital-only, it’s delivering a 561k reach and 2.9m hours. Greatest Hits, meanwhile, has a 1.4m reach and 7.7m hours in the capital. Not a bad decision!

In April, Lincs FM became FMless as it surrendered its analogue output to Greatest Hits Radio. Its reach is now 141k (down from 239k) and hours from 3m to 1.1m. Meanwhile, Greatest Hits Radio Lincolnshire, now on FM, is delivering 150k reach and 1.5m hours. Collectively that’s 2.6m hours - so down overall. But perhaps it’s early days for both.

Early days too for Gem 106 who are on a similar path. They gave up their FM to GHR at the beginning of Q4 but are measured over 6 months. Their last full RAJAR in Q3 gave them a 264k reach and 2.1m hours, so far this quarter they’re marginally down to 240k and 1.9m hours. GHR is up a little 174k to 188k in reach and 1.2m to 1.4m hours. We’ll know more of what happens next quarter.

Interestingly for Lincs and Gem, they are due to change again, being re-branded alongside most of Bauer’s heritage ILR stations in England as Hits Radio. We’ll see how this changes their figures further, later in the year.

Changes like these remain a sore point amongst radio fans, who feel the removal of local radio makes the medium seem somewhat reduced.

The birth of local radio, and its later financial success came much from regulation and the lack of media competitors (both radio and otherwise) for listening and for advertising revenue than it did the sparkling content.

I remember sitting in a client meeting with UKRD and hearing the Station Manager proudly stating that they weren’t running any national ads from (sales house) First Radio Sales (FRS), much to their annoyance. He was pleased because the local yield was around a £10 CPT per spot, whereas the national was £1.50. FRS were annoyed as this was a large station that they couldn’t deliver to their clients.

The station was able to do this because it had strong local advertisers, many of which couldn’t go elsewhere to reach a local audience - hence the price. Nowadays, whilst car dealers and double glazing companies are still good local radio targets, stations are competing with local targeting on Google and Facebook. It’s very much not the monopoly it was.

The changing nature of the ad market combined with the explosion in competition for listeners’ time means its harder to be able to afford a lot of local programming when your yield has been significantly reduced. Cutting the number of buildings and staff and delivering less local content, even if it reduces ratings, and broadcasting national material with some local opts is a much more profitable option for radio groups.

At the moment, a new bill is going through parliament that would mean radio groups would no longer have to provide any local programmes, providing they still deliver local news, travel and weather etc. This will mean it will be up to radio groups themselves whether the local content is worth the continued investment (for advertisers as well as audience). I am sure there will be some changes to the status quo - though I don’t necessarily think it will mean local programmes will disappear from all of the networks. We will see however.

For the big commercial radio groups, the changes to the local business model have happened alongside changes to the national one - all driven by consumer behaviour.

DAB Digital Radio now delivers 42.7% of all radio listening hours. Smart speakers deliver 14.7% which is over half the total hours from AM and FM radio. The digital platforms, when taken together, reach 86.5% of radio listeners and account for 72% of all listening hours. This huge digital reach means the stations listeners can choose have been widened massively.

Commercial radio’s business is driven by delivering hours to advertisers. Whereas previously the worry was about individual stations losing listeners and hours, now groups look towards the appeal of multi-station networks.

In Q1/2017, after many stations rebranded to Heart, they delivered Global 63.2m hours a week. Today that locally-delivered network, alongside their digital spin-offs generates 77m hours.

The people that invented the spin-off strategy was Absolute Radio. Clive Dickens, faced with a rebrand that hadn’t seemed to have gone to plan and an empty national digital radio multiplex, launched Absolute 80s as a hail mary. It worked. Not only delivering new hours to, at that time, the stand-alone Absolute Radio business, it also helped connect their main Absolute Radio with more listeners too. At the beginning of 2010 it had 13.6m hours, the network now delivers 33.1m for Bauer - a transformation.

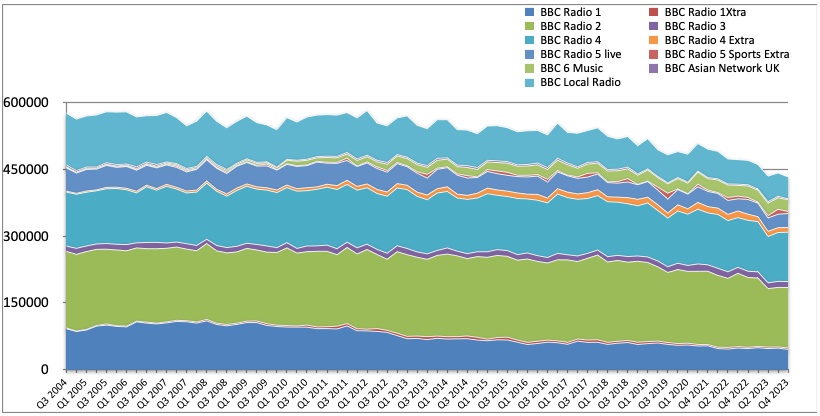

If we look at BBC listening hours over time, like many stations, it’s no surprise that they’ve dropped. There’s more competition after all. But the BBC’s lack of development of its own networks, stymied by commercial radio and government, means the decline is not something they can do much about.

On top of all of that, the BBC has had to deal with significant cuts to its funding whilst still required to deliver more content on more platforms. Also like many media organisations it’s looking to choose to invest more in its digital products so legacy operations will take a hit.

No one’s happy when something’s taken away that they like, but I find it hard to disagree that the BBC needs to ensure its broader digital offer is developed.

One of the things that has been hit by cuts is BBC Local Radio. The bosses have decided to regionalise some elements - afternoons for example - and nationalise some evenings and weekends. The decision making about the structure and line-up of the local stations has taken a long time, already disrupting schedules (and staff morale) before the changes started to kick in at the end of last year.

In the last year BBC Local Radio in England has dropped its reach from 5.6m to 4.8m. It’s similar across all day-parts:

With many local stations reporting over six months, I imagine the worst is still to come.

Fundamentally, right now, I don’t think these drops are particularly about the replacement of local shows with regional or national ones. This will be more about listeners losing presenters that they are used to, and on a more speech and company station this will have a greater impact than on a music brand, and prompt churn.

With all radio (or any products) perception can drive experience whether or not it has a basis in fact. In 2024, even a nearly entirely networked service like a Viking FM can use technology to appear, to many listeners, that it remains a local radio station. Split sweepers and presenter links, phone numbers, local news, weather and travel can all give the appearance of a local station. GWR was achieving this is the 90s after all too.

It seems mad that the BBC, trying to integrate local, regional and national programming into a local station environment, hasn’t managed to use all the techniques commercial radio has been using for over 30 years. As I hear it, it’s variable station to station whether shared local shows can split news/travel/weather and many of the regional and national shows don’t even have splits on station names or the ability for presenters to drop local links.

If I was tasked with delivering a new kind of localised radio, getting the technology to do it would be at the top of my list. ViLOR was a great technology for local radio stations but it isn’t what these new types of stations need.

Oddly with these network changes I think there’s actually the opportunity to do a lot more localisation and enhance elements of the local service with the right tech stack. It would at least have given me some good news if I had to defend my changes to a select committee.

I’m not as vociferous about these BBC Local Radio changes as some. Strategically I think much of what they are doing is correct. I share colleagues views about disagreeing how it’s been done, especially when local radio’s budgets remain - to my eyes - pretty healthy.

As all the examples from earlier in the post show, you can’t deal with today’s radio world without reimagining how we deliver great audio for listeners. You also can’t do it on old technology and thinking.

Personally I would have merged local radio with Five Live but maybe that’s another blog post!

Demographics

I think it’s always useful to look at radio’s demographics, particularly to battle away incorrect perception. Civilians are still surprised when I tell them that 88% of the population listen to some form of radio each week and collectively they listen to a billion hours of it too.

There’s also the classic that young people don’t listen to the radio any more. Also not true.

That’s not to say there aren’t things to be concerned about. 15-24 reach is continuing to drop a little, though it’s not particularly precipitous. The amount they listen to has stayed pretty steady (though it’s significantly less than other demographics).

As I’ve touched on before, the focus of radio groups has tended to be on stations with older listeners. Greatest Hits and Smooth are the ones with big advertising campaigns. I don’t see any for Radio 1, Kiss and Hits. Capital’s not marketing as much as they used to. It’s sensible - older is where the hours are - and that’s where you make your money. But I continue to worry that the radio industry doesn’t care about younger listeners as much as it should.

One station that’s done well over the past few years is for the oldies, Boom Radio. This quarter though it’s fallen back a little, its reach is now 627k, last quarter it was 662k. It’s still up on a year ago, when it was 531k. However a Boomer tells me that it was the under 55s that dropped, and that it has record 55+ listeners! See - those pesky younger listeners causing problems for everyone.

AOB

Remember that survey I mentioned at the beginning. Do you have something to do with music or podcasts? Then fill it in and you could win $1,000 and everyone gets a copy of either their State and Future of Music or Music’s Podcast Potential report. Fill in the survey here.

If you’re reading this, you should be a media person, so do please give my podcast - The Media Podcast - a try. It’s weekly and it covers radio, TV and journalism and has some brilliant insightful guests. I’ll give you your money back if you don’t like it. Check it out here.

Want more on RAJAR, Adam Bowie does an excellent round-up of who’s up and down.

If you’ve been forwarded this email from an enlightened colleague - do subscribe yourself - it’s free.