RAJAR Q2/25 - Further Youth Quake?

Is anyone doing anything about young people listening less to the radio?

Yesterday, Ofcom published its annual research into the nation’s media habits. Its core message, as it was in their earlier Transmission Critical report, was the effect YouTube’s been having on consumers - and therefore broadcasters too. Amongst their data, was the fact that 20% of children aged 4 to 15 head to the YouTube app as soon as they turn their TV on.

Changing consumer behaviour doesn’t just affect TV, the nation’s widening audio habits will impact traditional linear radio too. In fact, it already has.

You often hear that “young people don’t listen to the radio”. That is very provably false. Today’s RAJAR figures show that 75% of 10 to 18s listen to the radio each week, on average consuming over an hour a day. I think that, in today’s world, that’s pretty remarkable. However, that’s not to say there aren’t some serious warning lights flashing.

If you flash back 20 years ago, 91.4% of 10 to 18s were listening to the radio. It was 2.5m more than the 5.1m today (some down to the radio, some down to population changes). But if you look at the average amount of listening per listener, it renders those demo changes moot.

In Q2/2005 all radio listening for 10 to 18s had an average hours of 14.7. Today in Q2/2025 it’s 8.1 - about half.

Some say not to worry and that people grow into radio.

Four years ago, I looked at how average hours changes over time. I worked out that the amount you listened to the radio when you were 15 stays the same through the rest of your life.

I was interested to look again with the new data.

If we take someone who’s 30 to 38 today, their average hours today are 15.7. If we flash back 20 years when they were 10 to 18 it was 14.7. That’s pretty close.

If we take someone who is 50 to 58 today, their average hours are 24.5, when they were 30 to 38 it was 22.7. Again pretty close.

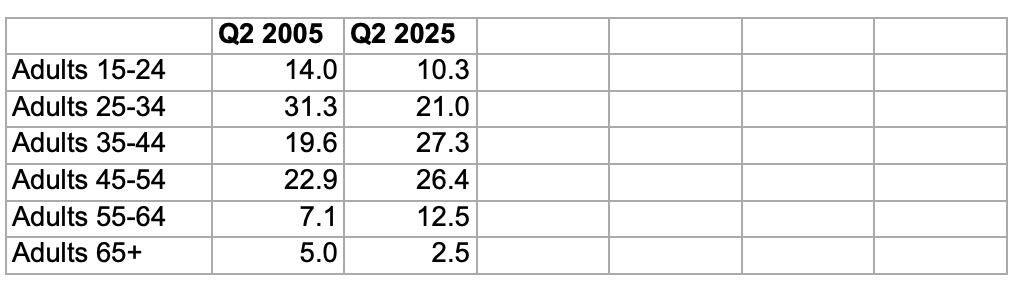

Commercial radio makes its money based on hours of listening. The less there are, the less money they make. You can already see some of this in today’s data. 15 to 24s average hours show a similar story to my 10 to 18s. It’s 10.3. If those youngsters coming through continue to stick at 8, when they become 25 to 34s then that demos hours will drop 40% (it’s currently 14.1) and as they go to 35 to 44s it’ll be 45% of the currently delivered 17.8.

Demographic and listening habit changes are hitting some stations hard already. BBC Radio 1 had 3.08m 10 to 18s tuning in in 2005, now it’s less than a third - 927k. Even if you strip out the population change, their reach of 10 to 18s in 2005 was 36.9%. Now it’s just 13.7%. They listen on average for 3.4 hours now vs 6.1 20 years ago.

The chart below shows Capital FM in London and the proportion of hours they get from each demographic. 20 years ago the biggest were 25-34s. But there are fewer of them now, and they listen to the radio less. So now the central demo is 35 to 44s with 45 to 54s not far behind.

It’s not just the demographics, the product is being shifted older.

Yesterday in the 1pm hour Capital played 15 songs, with just 5 of the tracks released this year and a further 3 from 2024. You would have also heard Avril Lavigne’s Complicated (2002, that’s 23 years old) and Justin Bieber’s Beauty and the Beat (2012, just 13 years old).

Back on the same day in 2010, Capital played 13 songs in the hour. 10 were from 2010 and the other 3 were from 2009.

No Avril Lavigne song appeared on Capital’s top 5000 airplay chart in 2010. This year, Complicated’s the 149th most played track, whilst Sk8r Boy is at 140 and I’m With You at 309.

I don’t blame Capital for going where the hours are. It’s been pretty successful for them. My worry for them and the other commercial radio groups is that they aren’t really doing anything to reach 10 to 18s particularly and less and less for 15 to 24s. Following the money today just guarantees more of a problem later on.

If radio doesn’t create and support teenagers and young listeners with audio products today, then it’s hard not to think they’re sowing the seeds of their later destruction.

Even at the BBCm their new launches Radio 1 Anthems and Radio 1 Dance will likely super-server 25 to 34s. Plus they wanted to launch a 55 plus station! If anyone should be doing the very hard and difficult work of reaching young listeners it should be the BBC.

Kids TV has seen investment drop significantly from commercial operators (only last week Sky Kids stopped commissioning new material), teenage TV has disappeared from the screens and provision of youth audio has been steadily dropping. I can’t see the BBC or commercial radio even bothering to make a teenage podcast. They have all given up.

Media operators can’t grumble about the YouTube threat and behaviour shifts of younger audience when they’ve clearly abandoned making any content for them.

Total Hours

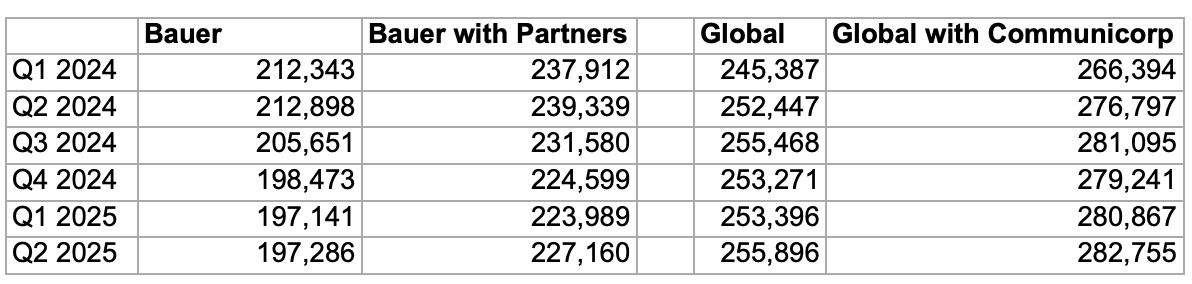

Back to the numbers… Across all the Capital stations they now deliver 48.9m hours, the Heart brand 82.8m hours and Smooth 50.3m hours. Global as a whole do 282m hours a week.

Over at Bauer, looking at the networks, Absolute’s on 34.1m, GHR’s on 65.9m, Hits on 45.8m, Kiss on 15.7m and Magic on 18.5m. Bauer overall are delivering 227m hours a week.

Both Global and Bauer’s total numbers are supported by other partners - a whole host of stations for Bauer and Communicorp stations for Global.

For Bauer though, one station is providing real benefit - and it’s someone else’s - Boom Radio. This quarter they delivered a stonking 11.1m hours. This is more than the whole of the Virgin Radio Network (9.3m) and pretty close to the main Magic station which delivers 11.3 and Gold with 11.6m

If anything, Boom’s success shows the power of average hours, they’re now delivering 15.7 per listener and for 55 plusses it’s 17.8. They’re also slightly insulated from the average hours trouble of the current 10 to 18s by about 50 years.

BBC

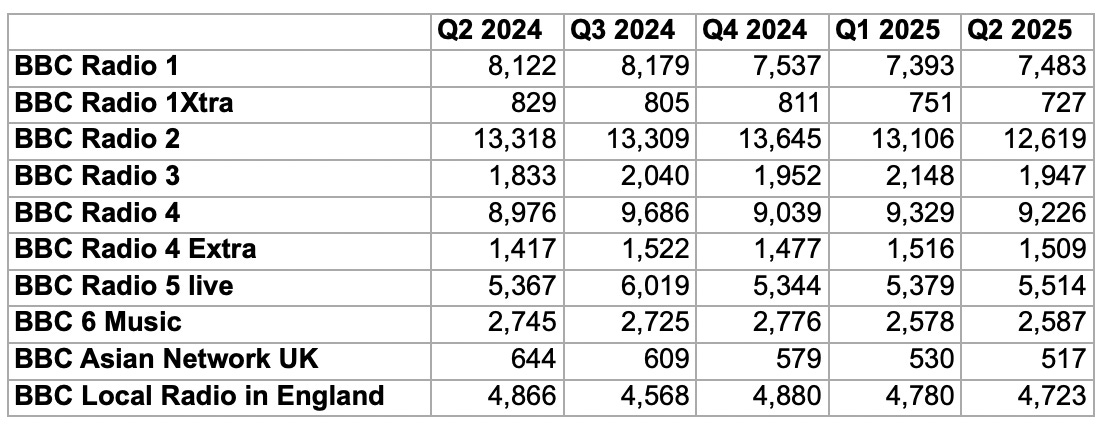

A quick look at the BBC and the reach for their national popular music stations have continued to face declines over the last year. They have been hit with an inability to launch new stations, whilst their competition went launch crazy.

Radio 2 at 12.6m is their lowest reach figure in over 20 years. Now, it still makes them the biggest single station in the country whilst Heart needs nine stations reach figures combined to just pip them with 13.0m listeners.

If you’re after some more details on the numbers rather than a Matt rant - then Adam Bowie’s rounded them up and Radio Today’s got all the headlines.

If you’re keen to analyse RAJAR data, I highly recommend Octagon from Hallett Arendt. Find out more on their website.

AOB

The Media Club podcast is on holiday at the moment. We’ll be back with an episode from the Edinburgh TV Festival at the end of August. In the meantime I caught up with Ofcom’s broadcasting boss to talk about consumer behaviour changes and want it means for broadcaster. Have a listen or watch!

p.s. You can tell the picture atop this blog post is AI - firstly it’s young people listening to the radio - and secondly, did you spot the random arm?

A well written and well researched piece Matt. Thank you for the breakdown. Thank you for sharing.

I work with media and radio stations in Africa and 80% of people living on this continent are under 30.

We have developed a number of brands that appeal to that demographic. The one we have in Uganda is aimed at 18-24. The big problem with that age demo is they don’t buy a great deal, maybe airtime, alcohol, nights out etc. So, we have had to not just rely on traditional airtime as a revenue source but to be very creative in our attempt to get revenue through the door, which so far we have been very successful at. This comes from OB’s, on ground activations for clients, club nights plus developing a number of platforms that should compliment our audience that have yet to be released. Plus we sell heavily across our strong digital platforms.

Our programming is very disruptive and predominatley presented by social media influencers that the target audience can relate to, that are trained to understand how radio works.

I’m sure the big players in the UK would struggle to make this work for them, but it works for us and we are growing with our key demo across all marketplaces and also attracting our secondary demo 14-17 in big numbers, for them we are turning up at their schools executing heavily sponsored roadshows, plus schools pay for us to appear with our team. So, radio is an attractive proposition, if you give them something that appeals to them.

"You can tell the picture atop this blog post is AI - firstly it’s young people listening to the radio" - ooof, burn!