Audio Use in the UK

Looking at Ofcom's Media Nations report

Ofcom’s Media Nations report is an excellent analysis of media consumption and trends, with a great section on radio and audio.

One of the opening paragraphs is a good overall analysis of the sector

Consumers continue to listen to radio and audio content on a wide range of devices. Although listening to live radio on a radio set has been in decline for the past few years, for adults overall it continues to account for much of their audio consumption. Conversely, consumption of digital audio services, including online live radio, music streaming services and podcasts, has grown over time, especially among adults aged 15-34 for whom live radio on a radio set now accounts for less than a quarter of listening.

If you’re in the audio business, this is great news. If you’re just in the radio business then it might come as a bit of a shock.

The Ofcom data grapples with lockdown listening, something lots in the media have a hard time doing. It’s fascinating to look at, though with many people’s return to ‘real life’ still on hold, perhaps we haven’t got the entire picture.

However, are we actually going to return to life like in the before-times? Have the changes to our media consumption over the past 18 months created new behaviours that are going to stick?

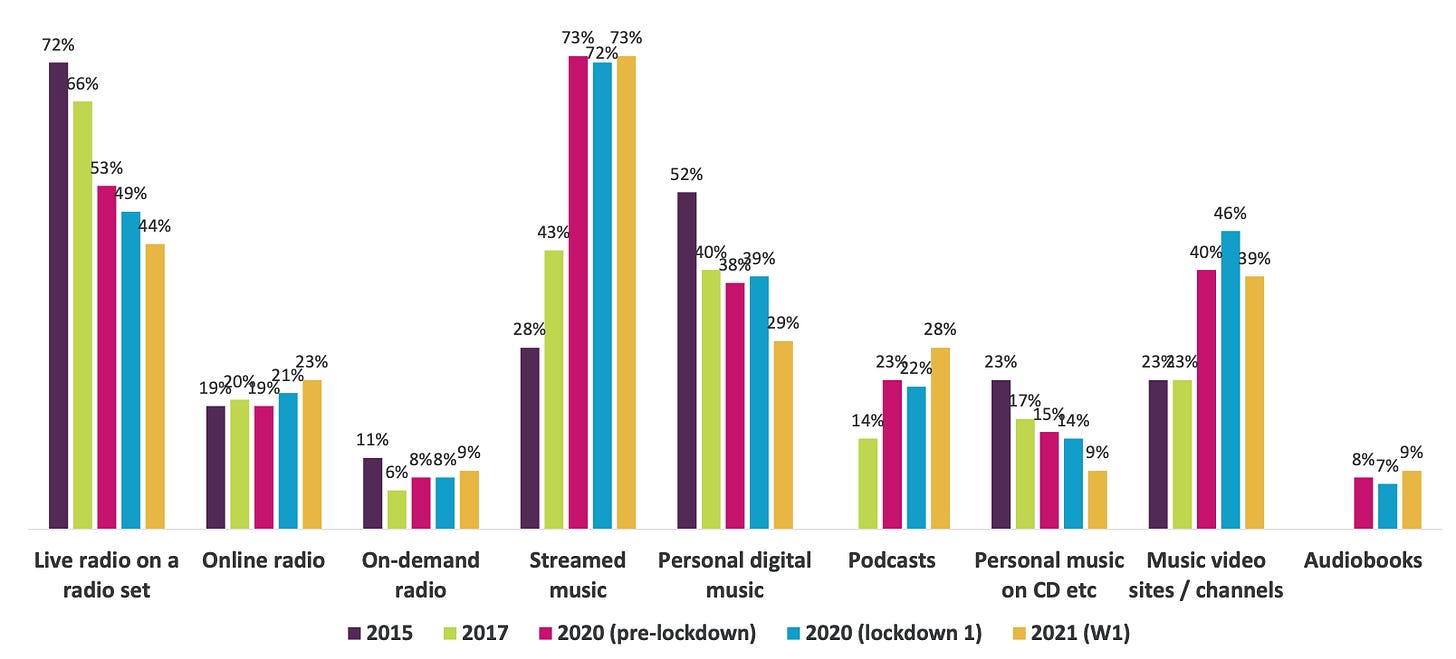

The chart below shows weekly reach of selected audio activities for 15 plusses from 2015 to today. Live radio set listening is still pretty strong, but the decline is 20 points, offset a little by the 7 point increase from online radio, but still a 13 point net loss. Podcasting is up but only around 4 points over the same period.

The radio industry, over lockdown, and without RAJAR has been keen to trumpet the growth in online audio and particularly from smart speakers. The problem with being excited by that is there’s been little recognition of what’s happening to the other ways of listening. If we look at 2020 pre-lockdown to today, radio set listening is down 7 points whilst online radio is just up a point. Again a net loss of 6 points.

Streaming music meanwhile, that’s the Spotifys of the world, alongside music video sites and channels (think YouTube) had seen their main growth in the 2017 to 2020 period. Over the pandemic, it’s been pretty static.

What’s driving these big 2017 to 2020 shifts is 15 to 34 year olds. The data broken down for them, below, just exaggerates the same story.

For 15 to 34s, the 2017 to 2020 pre-lockdown period is where live radio set listening took a 13 point dive, before lockdown knocked another 9 points off. In 2017 live radio set listening was still the number one way of consuming audio for 15 to 34s, but by 2020 streamed music and music had jumped ahead, with music video not far behind. Lockdown has seemingly locked that change in.

That’s reach. It’s even more interesting to look at hours. Here’s share of listening by different audio media types for all adults (15+). What this shows is that lockdown didn’t change total consumption that much. It was the 2017 to 2020 period again when the most change happened. Pre and post lockdown it’s roughly the same proportion of live listening.

Indeed, the large reach decline for live radio sets hasn’t been replicated in hours terms. Has radio merely lost the light listeners? Or are the old listeners, the 55 plusses just holding up radio’s end?

Well looking at the 15 to 34 breakdown, lockdown does seem to have had much more of an affect on how they’ve been listening.

Again, we saw the big shift in consumption being between 2017 and 2020, but this time the pandemic has accelerated the shift, with the 8 or 9 percentage points of further decline in radio’s set share being divvied up amongst other media. Once again though, it hasn’t been gifted to streaming music whose volumes have stayed pretty static. It’s mainly podcasts and video that’s been the beneficiary.

Young listening

Live radio set listening, even combined with online radio listening, definitely has a consumption problem with younger audiences. It’s also a problem for advertisers too. With the lion’s share of audio going to streaming (a large proportion of which is ad-free through subscription services), getting into younger ears is pretty tough. Yes, there’s been some podcast growth, but not at the scale of share loss from ad-supported radio.

Of course this isn’t that dissimilar to the challenges in television.

The chart below shows minutes of consumption over time. All viewers on the left, 16 to 34s on the right. Both sides follow the same pattern, but it’s driven by the younger audiences and their abandonment of Live TV for SVoD - subscription video services like Netflix and Prime Video, with some steady increases in YouTube use.

Catch-Up

What we can see both in these charts for radio and television is that broadcaster catchup, whether that’s ‘BVoD’ (on demand from regular TV broadcasters) or ‘catch-up radio’ and ‘radio podcasts’ - none of its a ‘thing’ for young audiences. It’s barely a thing for other audiences too.

Listen again or catch-up has little resonance. It would seem to be seen as just recycled content - old stuff. The data would show that the need it caters for is a small one, whilst new and exclusive material seems to satisfy far more people.

You could argue that maybe it’s just all in the branding and I don’t necessarily disagree. But right now catch-up seems a write-off.

So maybe now’s the time to kill off that ‘best of the breakfast show’ podcast that has crap figures, and use your breakfast talent to build something new and exciting.

Taken together, radio output for young people - live or on-demand - seems to be losing the battle for attention. A problem that’s part content, part marketing and part platform. I’m intrigued what the next set of RAJAR data tells us, after an 18 months gap. I think there might be a shocker for 15 to 34 stations coming and perhaps this Ofcom data is just the canary in the coal mine.